As a Florida insurance agent, your goal is to get your clients the best coverage at the best rate — and to bind that policy quickly. Here is what you need to know about working with home inspectors to streamline your underwriting process.

The "Big Two" Reports: Speed and Accuracy Matter

We know that a delay in receiving a report can mean a lost policy. That's why we prioritize:

- Same-Day Turnaround: We typically deliver reports within 24 hours (often same-day).

- Bindable Reports: Our reports are reviewed for completeness to avoid kickbacks from underwriting.

1. Wind Mitigation (Form OIR-B1-1802)

This is your client's best friend for premium relief. We ensure:

- Clear Photos: Legible photos of roof-to-wall connections, nail spacing, and SWR compliance.

- Correct Form Usage: We strictly follow the OIR-B1-1802 specifications accepted by all carriers, including Citizens.

- Permit Verification: We cross-reference permit history to backup roof age claims.

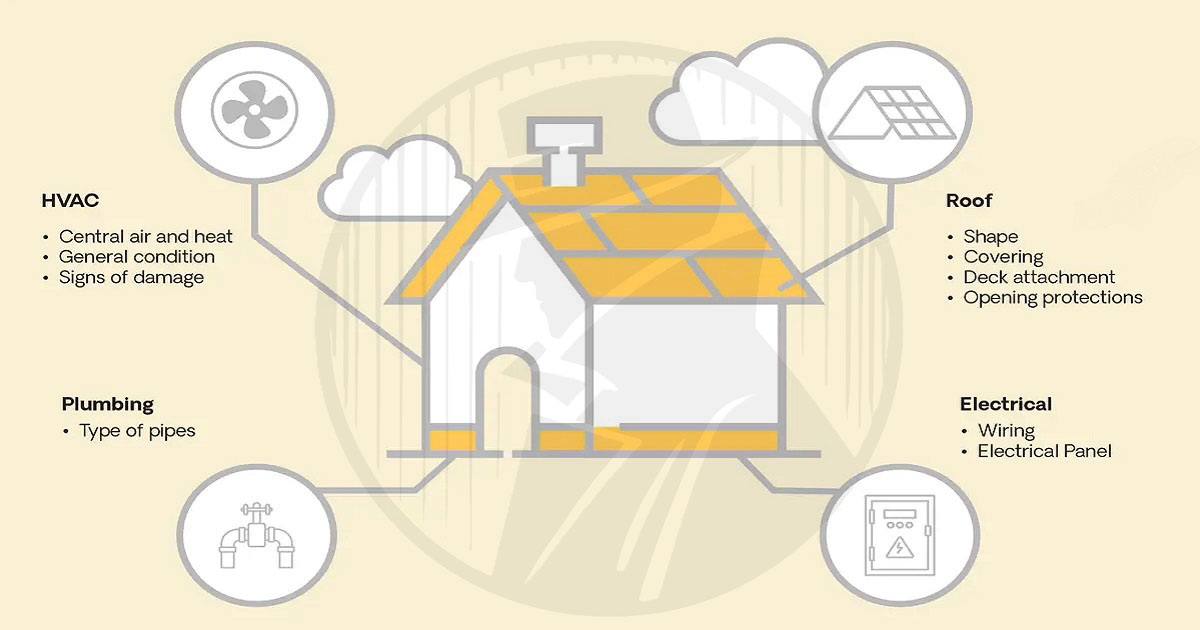

2. 4-Point Inspection

Required for most homes over 30 years old (and increasingly for newer homes). Our focus is on the "deal killers":

- Electrical: We clearly identify panel brands (checking for FPE/Zinsco) and wiring types (copper vs. aluminum vs. cloth).

- Plumbing: We verify pipe materials (checking for polybutylene) and water heater age.

- Roof Life: We provide realistic remaining life estimates to satisfy underwriting guidelines.

Why Partner with Mayne Inspectors?

We see ourselves as an extension of your team. When you refer a client to us, you can trust that we will providing the accurate, technical data you need to write the policy, without alarming the buyer unnecessarily.

Need a quick consultation on a tough-to-insure property? Call us directly. We are here to help you close.