If you own an older Florida home, your insurance company has probably asked for a 4-Point Inspection. But what exactly is it, and why do they need it?

What is a 4-Point Inspection?

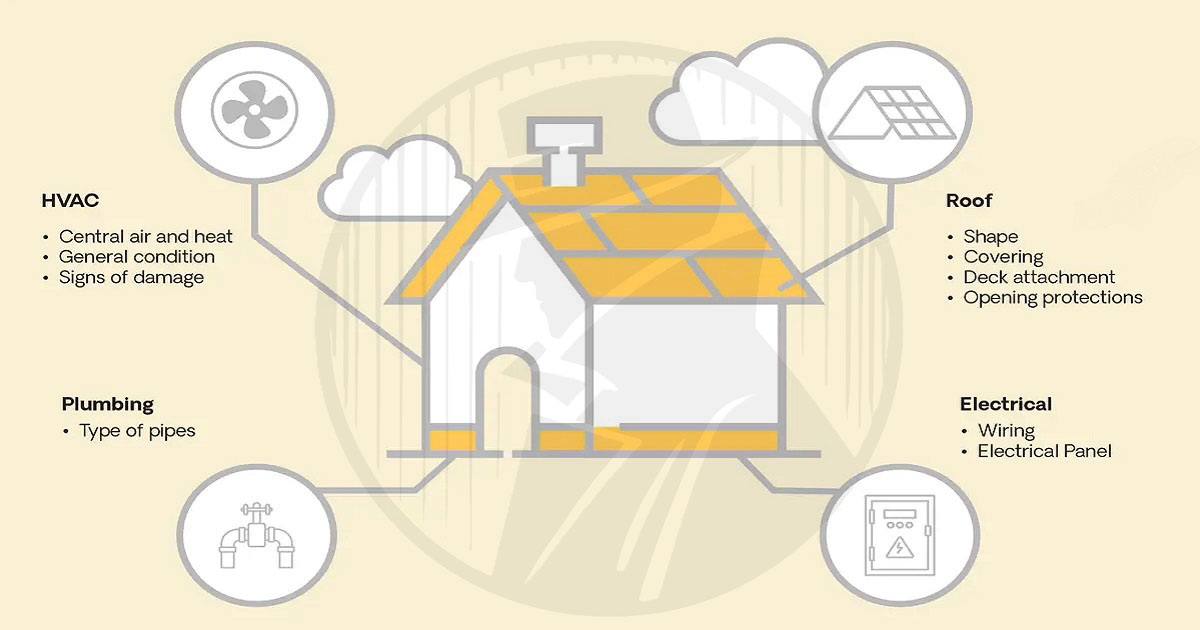

A 4-Point Inspection focuses on the four major systems that insurance companies care most about:

- Roof

- Electrical

- Plumbing

- HVAC (Heating, Ventilation, Air Conditioning)

Unlike a full home inspection, the 4-Point doesn't cover every aspect of the home — just these four critical systems.

Why Do Insurance Companies Require It?

Insurance companies use 4-Point inspections to assess risk. Older homes (typically 25+ years) are more likely to have:

- Outdated electrical panels (like Federal Pacific or Zinsco)

- Aging roofs more susceptible to storm damage

- Polybutylene or galvanized plumbing prone to leaks

- Inefficient or failing HVAC systems

The inspection helps them decide whether to insure your home and at what rate.

What Does Each Section Cover?

1. Roof

- Age and condition of shingles/tiles

- Signs of damage or wear

- Estimated remaining lifespan

- Recent repairs or replacements

2. Electrical

- Panel type and condition

- Wiring type (aluminum vs. copper)

- Amperage capacity

- Visible safety hazards

3. Plumbing

- Pipe material (copper, PVC, PEX, etc.)

- Water heater age and condition

- Signs of leaks or corrosion

- Main shut-off valve location

4. HVAC

- Age and type of system

- Cooling capacity vs. home size

- General condition and maintenance

- Heat source type

How to Prepare

To ensure a smooth inspection:

- Make sure all systems are accessible

- Have maintenance records ready if available

- Replace HVAC filters

- Clear area around electrical panel

What Happens If You Fail?

You can't really "fail" a 4-Point, but insurers may decline coverage or require repairs for:

- Roofs over 20-25 years old

- Federal Pacific, Zinsco, or fuse panels

- Polybutylene plumbing

- Non-functional HVAC

If issues are found, you may need to make repairs before obtaining bindable reports for insurance.